Savings Tracker Printable PDFs⁚ A Comprehensive Guide

Saving money can be a challenge‚ but printable PDFs can help you stay on track. These digital tools allow you to create a visual representation of your savings goals and monitor your progress. With various designs and formats available‚ you can find a savings tracker printable PDF that fits your needs and preferences. Whether you’re saving for a specific goal‚ paying off debt‚ or building an emergency fund‚ these printable PDFs offer a simple yet effective way to manage your finances and achieve your financial objectives.

What is a Savings Tracker Printable PDF?

A savings tracker printable PDF is a digital document designed to help you track your savings progress. It typically includes a table or chart where you can record your savings goals‚ starting balance‚ target date‚ and regular contributions. These printable PDFs are often customizable‚ allowing you to adjust the format‚ layout‚ and design to suit your preferences. They are also readily available online‚ with many free options available for download.

The main purpose of a savings tracker printable PDF is to provide a visual representation of your savings journey. By seeing your progress in a tangible format‚ you can stay motivated and on track towards achieving your financial goals. These printable PDFs can help you visualize how your savings are accumulating‚ encouraging you to stick to your budget and make regular contributions.

In essence‚ a savings tracker printable PDF is a simple but powerful tool that can enhance your savings efforts. It provides a structured way to track your progress‚ visualize your goals‚ and stay motivated to reach your financial aspirations.

Benefits of Using a Savings Tracker Printable PDF

Using a savings tracker printable PDF offers numerous benefits that can significantly improve your financial management and savings journey. Here are some key advantages⁚

Firstly‚ a printable PDF provides a tangible and visual representation of your savings progress. This visual aspect can be highly motivating‚ allowing you to see your savings grow and track your progress towards your goals. It can also help you stay accountable for your financial commitments and avoid impulsive spending.

Secondly‚ these printable PDFs can be customized to suit your specific needs and preferences. You can choose from various formats‚ layouts‚ and designs‚ ensuring that your savings tracker aligns with your personal style and financial goals. This flexibility allows you to tailor the tracker to your specific requirements‚ making it more effective and engaging.

Thirdly‚ savings tracker printable PDFs are often free and readily available online. This accessibility makes them an affordable and convenient tool for anyone looking to improve their savings habits. You can easily find a suitable template that meets your needs and download it without any financial cost.

Finally‚ these printable PDFs can help you stay organized and manage your finances effectively. By tracking your savings‚ you can gain a better understanding of your spending habits and identify areas where you can cut back to increase your savings potential. This improved awareness can lead to more efficient budgeting and ultimately‚ faster progress towards your financial goals.

Types of Savings Trackers

Savings tracker printable PDFs come in a variety of types‚ each designed to cater to different needs and saving goals. Here are some common types you might encounter⁚

Monthly Savings Trackers

These trackers focus on tracking your savings on a monthly basis. They typically include sections to record your income‚ expenses‚ and net savings for each month. They can be helpful for individuals who want to monitor their savings progress on a regular basis and make adjustments to their budget as needed.

Yearly Savings Trackers

Yearly savings trackers provide a broader perspective on your savings progress over a 12-month period. They often include sections to set annual savings goals‚ track monthly contributions‚ and visualize the cumulative savings over the year. These trackers are ideal for individuals who have long-term savings goals‚ such as purchasing a home‚ paying off debt‚ or funding retirement.

Goal-Specific Savings Trackers

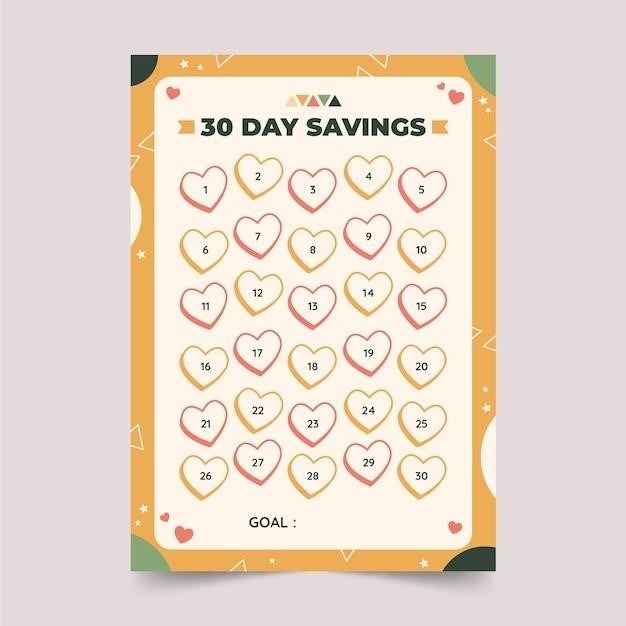

Goal-specific savings trackers are designed to help you save for a particular item or experience. These trackers typically include sections to define the specific goal‚ set a target amount‚ and track progress towards reaching that target. They can be highly motivating as they provide a clear focus and visual representation of your progress towards achieving your desired goal.

By choosing the right type of savings tracker‚ you can effectively track your progress‚ stay motivated‚ and achieve your financial objectives.

Monthly Savings Trackers

Monthly savings trackers are designed to provide a detailed snapshot of your financial activity within a single month. These printable PDFs typically include sections to record your income‚ expenses‚ and net savings for each month‚ offering a clear picture of your financial inflows and outflows.

One key advantage of monthly savings trackers is their ability to promote mindful spending. By regularly tracking your expenses‚ you can identify areas where you might be overspending and make informed decisions to adjust your spending habits. This level of awareness can lead to significant savings over time.

Monthly savings trackers are also valuable for setting and achieving short-term savings goals. By tracking your progress on a monthly basis‚ you can assess your progress towards reaching your target amount and make necessary adjustments to your budget or savings contributions.

These trackers often include additional features such as budgeting categories to help you categorize your expenses‚ goal-setting sections to define your monthly savings goals‚ and progress tracking tools to visually represent your savings journey.

Whether you’re aiming to build an emergency fund‚ save for a vacation‚ or simply improve your overall financial management‚ a monthly savings tracker can be a valuable tool for achieving your financial goals.

Yearly Savings Trackers

Yearly savings trackers offer a broader perspective on your financial progress‚ allowing you to track your savings over an entire year. These printable PDFs typically include a breakdown of monthly savings goals‚ providing a clear roadmap to achieve your annual financial targets.

Yearly savings trackers are particularly useful for individuals with long-term financial aspirations‚ such as saving for a down payment on a house‚ retirement planning‚ or funding a significant travel adventure; By breaking down your annual goal into smaller‚ monthly targets‚ these trackers make the daunting task of saving seem more manageable.

One of the key benefits of yearly savings trackers is their ability to promote consistency. By tracking your savings progress over an extended period‚ you can identify any patterns or trends in your spending habits‚ helping you to maintain a consistent savings discipline throughout the year.

Many yearly savings trackers also incorporate additional features‚ such as progress bar charts to visualize your savings journey‚ sections to record your income and expenses for each month‚ and notes sections to jot down any relevant financial observations or goals.

If you’re looking to achieve substantial financial milestones‚ a yearly savings tracker can be a valuable tool for staying motivated‚ maintaining consistency‚ and celebrating your financial progress along the way.

Goal-Specific Savings Trackers

Goal-specific savings trackers are tailored to help you achieve specific financial objectives‚ whether it’s purchasing a dream car‚ planning a memorable vacation‚ or saving for a down payment on a house. These trackers provide a focused approach to saving‚ allowing you to visualize your progress towards your targeted goal.

The design of goal-specific savings trackers often incorporates elements that enhance motivation and engagement. They may include progress bars that visually represent the percentage of your goal achieved‚ sections to record your progress towards milestones‚ and motivational quotes or affirmations to encourage persistence.

A key advantage of using goal-specific savings trackers is their ability to foster a sense of accomplishment and reinforce your commitment to achieving your objective. As you track your progress‚ you’ll be able to see the tangible results of your efforts‚ boosting your motivation and confidence.

These trackers can also be a valuable tool for budgeting and prioritizing your spending. By focusing on a specific goal‚ you’ll be more likely to make conscious decisions about how you allocate your funds‚ ensuring that your spending aligns with your financial objectives.

Whether you’re saving for a short-term goal or working towards a long-term dream‚ a goal-specific savings tracker can provide the structure‚ motivation‚ and clarity you need to stay on track and achieve your financial aspirations.

Essential Features of a Savings Tracker Printable PDF

A well-designed savings tracker printable PDF should incorporate essential features that enhance its functionality and user-friendliness. These features aim to make the process of tracking your savings more efficient‚ organized‚ and motivating.

One crucial feature is a clear and concise layout that allows for easy data entry and visualization. The tracker should include sections for recording your income‚ expenses‚ and savings contributions. This structured format ensures that you can accurately track your financial activity and identify areas for improvement.

Another important feature is the ability to set savings goals and track your progress towards achieving them. The tracker should include spaces to define your savings goals‚ specify target amounts‚ and record your cumulative savings. This allows you to monitor your progress‚ stay motivated‚ and adjust your savings strategy as needed.

Additionally‚ a well-designed savings tracker printable PDF should provide space for notes and reflections. This allows you to document your financial decisions‚ identify spending patterns‚ and reflect on your progress. These insights can help you make informed decisions about your financial future.

Furthermore‚ the tracker should be visually appealing and easy to use. This can involve using a clear font‚ well-defined sections‚ and color coding to enhance readability and engagement. A visually appealing tracker can make the process of tracking your savings more enjoyable and motivating.

Finding Free Printable Savings Trackers

The internet offers a wealth of free printable savings trackers‚ making it easy to find one that suits your needs and preferences. You can discover a wide array of designs‚ formats‚ and features to help you effectively manage your finances.

One popular source for free printable savings trackers is websites dedicated to personal finance and budgeting. These websites often offer downloadable PDFs that you can print and use to track your savings. Many of these trackers are designed to be user-friendly and include helpful features such as goal setting‚ progress tracking‚ and expense categorization.

Another excellent option is to search for free printable savings trackers on online marketplaces like Etsy. Etsy is known for its unique and handcrafted items‚ and you can find a variety of printable savings trackers designed by independent artists and creators. These trackers often feature creative designs and personalized touches‚ making them more engaging and enjoyable to use.

Additionally‚ you can find free printable savings trackers on blogs and websites dedicated to personal productivity and lifestyle organization. These resources often offer printable tools and templates that can be helpful for managing different aspects of your life‚ including your finances.

Remember to check the terms and conditions of the website or platform where you download your free printable savings tracker. Some websites may require attribution or may have restrictions on how you can use the tracker. It’s always best to review the terms before downloading and using any printable resources.

Tips for Using a Savings Tracker Printable PDF

Maximizing the effectiveness of your printable savings tracker requires a strategic approach. By implementing a few simple tips‚ you can ensure that this tool becomes an indispensable part of your financial journey.

Firstly‚ choose a tracker that aligns with your specific savings goals. Whether you’re aiming to save for a vacation‚ pay off debt‚ or build an emergency fund‚ select a tracker designed to cater to your unique financial objectives. This ensures that your tracker remains relevant and motivating throughout your savings journey.

Secondly‚ dedicate a designated space for your tracker. This could be a specific drawer‚ a designated area on your desk‚ or even a designated folder on your computer. Having a dedicated location for your tracker enhances its visibility and encourages regular engagement.

Thirdly‚ establish a consistent routine for updating your tracker. Whether it’s daily‚ weekly‚ or monthly‚ set aside time to record your savings progress. This regular practice fosters accountability and allows you to monitor your financial progress.

Fourthly‚ personalize your tracker to enhance its appeal. Add colorful stickers‚ highlights‚ or decorations to make it visually engaging. Personalizing your tracker can boost your motivation and make the process more enjoyable.

Finally‚ celebrate your milestones. As you reach your savings targets‚ take time to acknowledge your achievements. This positive reinforcement can fuel your motivation and encourage continued progress. By following these tips‚ you can effectively utilize a printable savings tracker to achieve your financial goals and create a more secure financial future.

In the realm of personal finance‚ printable savings trackers emerge as valuable tools for individuals seeking to achieve their financial aspirations. These readily accessible and customizable resources offer a tangible means to visualize savings goals‚ monitor progress‚ and foster a sense of accountability.

By leveraging the benefits of printable savings trackers‚ individuals can gain a deeper understanding of their spending patterns‚ identify areas for potential savings‚ and develop a disciplined approach to financial management. These trackers act as a constant reminder of financial objectives‚ encouraging consistent savings and promoting a mindset of financial well-being.

Whether you’re saving for a dream vacation‚ a down payment on a home‚ or simply building an emergency fund‚ a printable savings tracker can be a powerful ally in your journey towards financial independence. The act of physically recording savings progress can be a motivating factor‚ instilling a sense of accomplishment and fueling determination to reach financial goals.

Ultimately‚ printable savings trackers offer a simple yet effective solution for those seeking to enhance their financial discipline and achieve their savings targets. By embracing these valuable tools‚ individuals can embark on a path toward a more secure and prosperous financial future.